With traditional sources of capital constricting and borrowers struggling to meet tighter lending standards, the real estate capital markets are facing ample headwinds. Lenders’ risk mitigation strategies require investors to contribute a more significant proportion of equity to the deal. This has made financing very difficult for many companies, especially in the realm of triple net (NNN) financing. In many cases, deals are no longer making sense. Unfortunately, margins have become very thin.

Triple net financing can be a valuable option for businesses that are looking to secure capital without taking on a large amount of debt. However, the amount and speed of interest rate hikes, a tightening lending environment, a slowdown in property trades and a bid/ask gap between buyers and sellers are making it more difficult for net lease investors to complete acquisitions in today’s market. For example, Cruise, the self-driving car company, was unable to secure NNN financing in 2022. This was due to the company’s weak financials and the uncertain future of the self-driving car industry. Another example is Lordstown Motors, the electric vehicle company. They were unable to secure NNN financing in 2023 due to the company’s declining sales and the recall of its flagship vehicle, the Endurance.

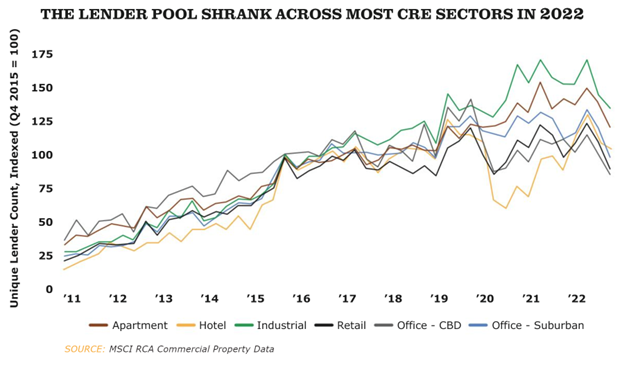

In the construction industry, lending does take place, but like other aspects of CRE financing, it’s getting more complicated. The pool of available capital is shrinking and becoming more costly with the uncertainty of the economy. Compounding matters are construction costs, which are also rising. Developers are finding themselves in an untenable situation, with spreads that are no longer attainable. So unlike 12 months ago, many construction deals are just not making sense for lenders right now.

But, there is an upside.

Unlike the Great Financial Crisis (GFC), experts agree that this is a liquid real estate recession with plenty of capital waiting in the wings. Investment activity will increase as inflation indicators decrease and the Fed’s aggressive stance eases. There is continued demand in the retail sector and Ryan McArdle of The Palomar Group related that fresh inventory has been starting to come on line within the past six months. “Opportunities are presenting themselves in the market,” he confirmed, “and deals can be had if buyers can figure out their debt financing.”

There are companies that have seen success in obtaining financing through all this turbulence. DoorDash secured $1.5 billion in NNN financing in 2022. This financing will allow DoorDash to expand its network of restaurants and grocery stores. Netflix secured $500 million in NNN financing in 2022 which will allow Netflix to expand its global footprint and build new data centers.

McArdle has noticed that in the past year, credit unions and credit union funds have also stepped in to provide funding on a larger scale outside their markets. According to data from the National Credit Union Administration, these lenders had $129.1 billion in commercial loans outstanding in the fourth quarter of 2022, an increase of 24.5% from the prior year.

Retail real estate has proven itself healthy, and there is a rebirth and repositioning underway that investors are noticing. Despite current headwinds buffering the sector, the horizon looks promising. The industry has absorbed lessons learned and many new innovations were tested during the pandemic. They learned how to adjust and reposition for growth. They continued to evolve. We all must continue to evolve to be successful.