The COVID-19 pandemic (the “Pandemic”) triggered a series of events that turned the commercial construction industry upside down. Nationwide government lockdowns that started in March of 2020 yielded increased demand for materials, supply chain disruptions, labor shortages, and a long inflationary period, sending construction costs through the roof. This perfect storm caused unprecedented construction prices and forced the construction community to relook at construction materials and methods – some projects were put on hold or canceled.

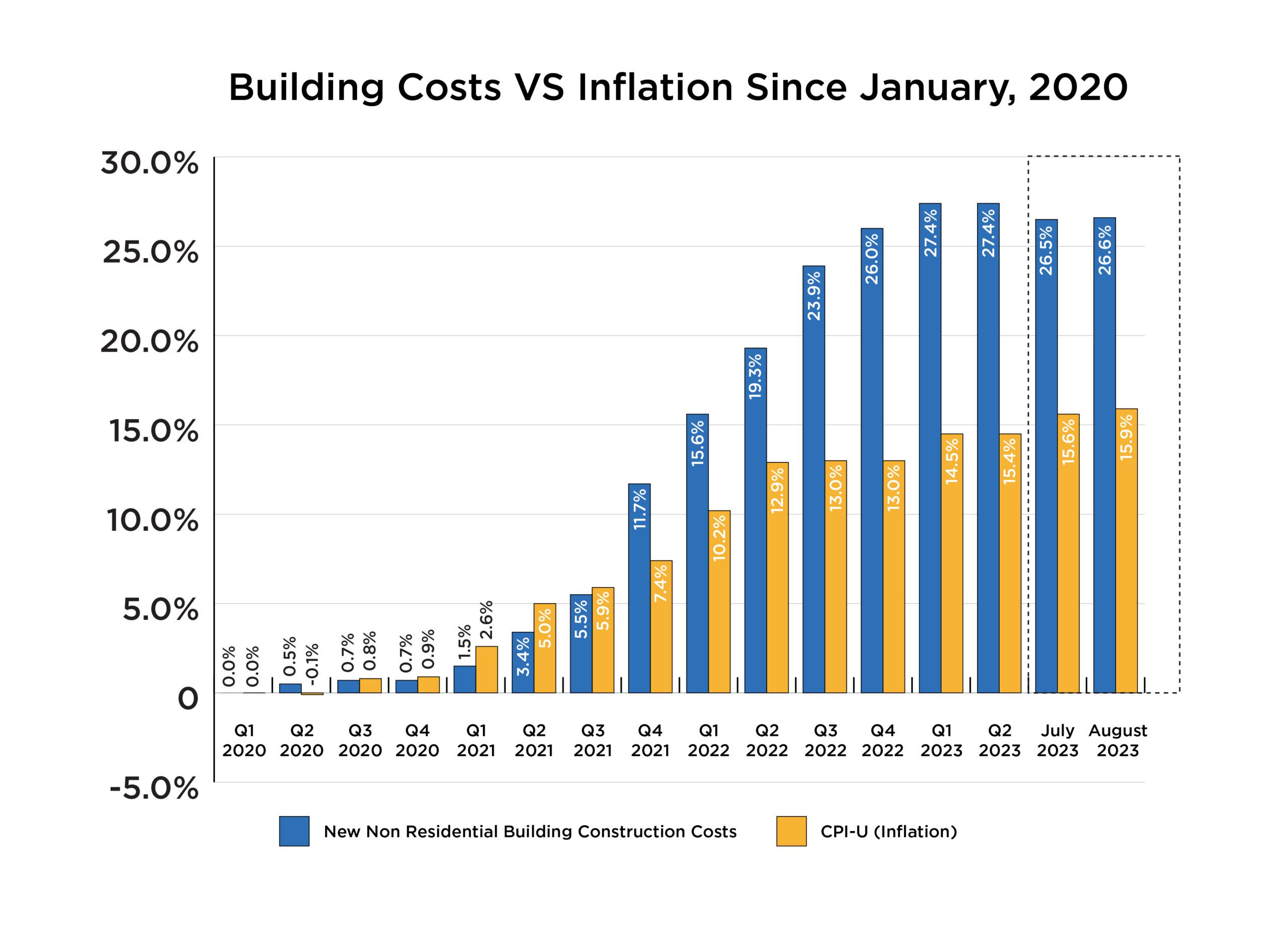

According to Bureau of Labor Statistics (BLS) data, towards the end of 2021, the rate increase of New Nonresidential Building Construction Costs skyrocketed over the inflation rate, leaving developers scrambling to figure out how to make their projects pencil. This was caused by pent-up demand for new construction projects due to the lockdowns, government stimulus programs, and a low supply of available materials. The rate of increase for New Nonresidential Building Construction Costs since the Pandemic doubled from Q3 2021 to Q4 2021.

Today, New Nonresidential Building Construction Costs have appeared to peak and flatten over the first half of 2023. July BLS data reflected the first notable drop in construction costs since the Pandemic, which could be a positive sign for developers looking for price relief in the near future.

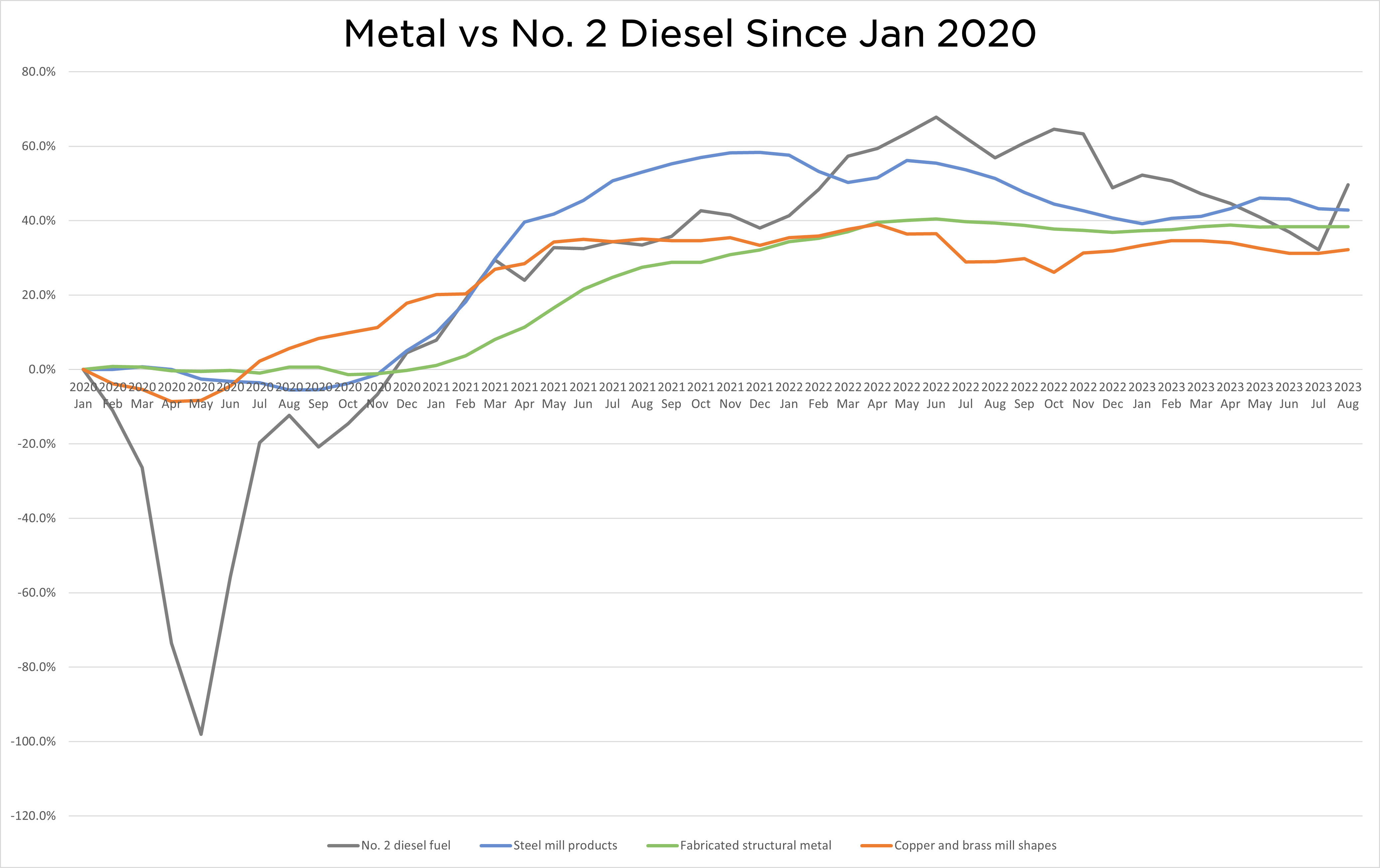

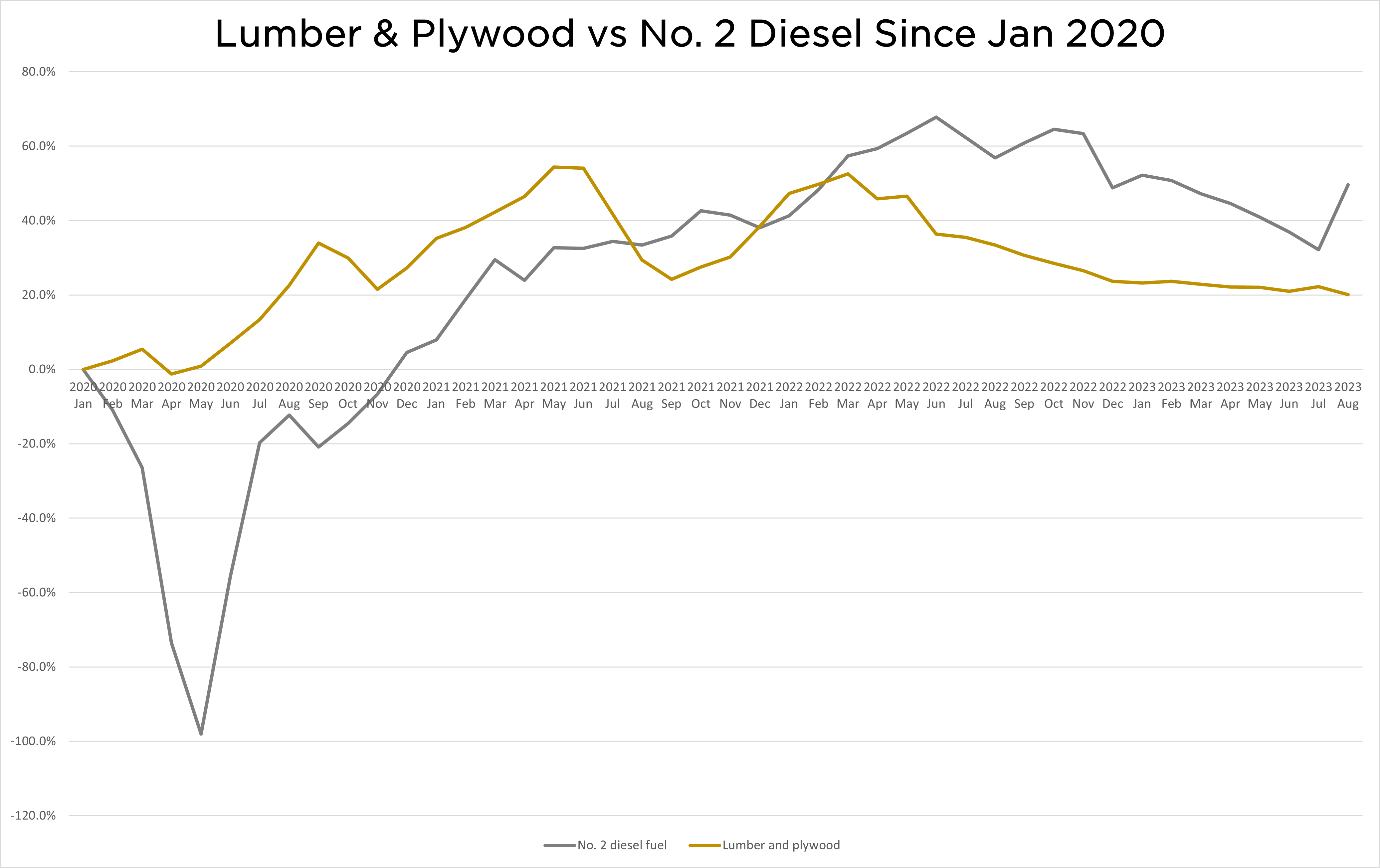

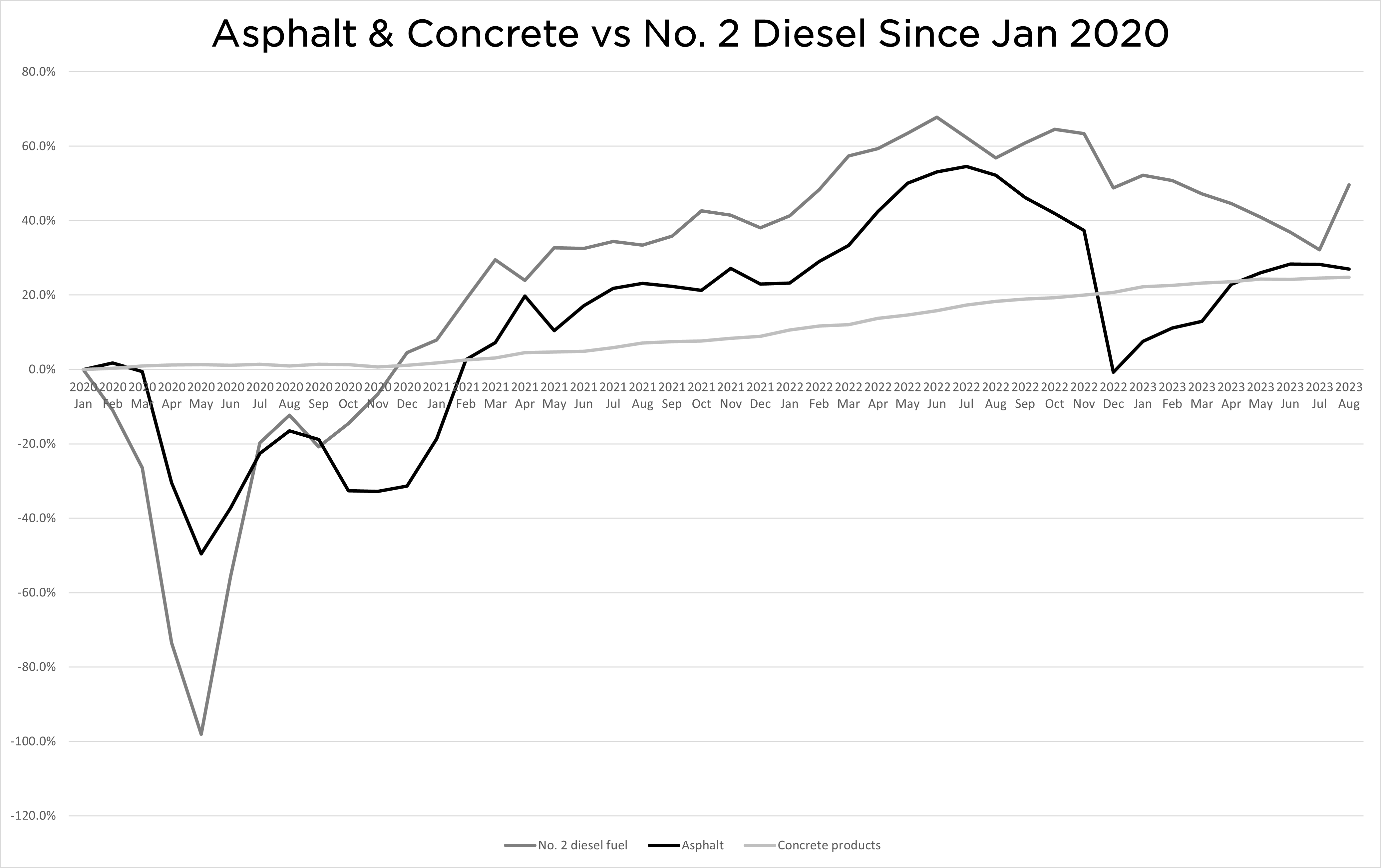

Our team evaluated the Producer Price Index from the BLS and rate increases for processed goods that are important to construction. Rising prices at the pump fueled the rate increase of many processed goods. No. 2 Diesel Fuel peaked in the Summer of 2022 and increased 52% since the Pandemic.

Many metal categories followed No. 2 Diesel Fuel, with Steel Mill Products increasing by over 43% since the Pandemic. These goods include cast or rolled materials like rebar, beams, plates, wire, and pipe. Fabricated Structural Metal is used for building frames, beams, columns, and trusses, which increased 38% since the Pandemic. Notably, Copper and Brass Mill Shapes are used for electrical wiring and plumbing and have increased 31% since the Pandemic.

Many commercial projects utilize steel framing systems, but pricing hurdles have forced developers to consider wood frame construction materials as an alternative framing system. Lumber and Plywood have been volatile and peaked in the Summer of 2021 and again in the Spring of 2022. Since then, Lumber and Plywood prices have slowly dropped and increased only 22% since the Pandemic.

Asphalt and Concrete make up a significant portion of site work costs for New Nonresidential Building Construction. Asphalt is used for parking lots in many areas throughout the country (especially in the desert Southwest). Asphalt is derived from crude oil, and the Asphalt index peaked in the Summer of 2022 along with crude prices and dove back to equilibrium at the end of 2022. Several factors triggered this dive, which included falling crude prices and rising inventories due to reduced construction activity. Today, Asphalt has increased 28% since the Pandemic.

Concrete is used for flatwork and parking lots, among other items, and has steadily increased 24% since the Pandemic. It should be noted, from our experience, that upfront concrete pricing is substantially more expensive than Asphalt. Concrete is the preferred construction material for parking lots in more humid areas like Texas and Florida. Concrete prices continue to impact areas where asphalt is not a preferred construction material for parking lots.

Last week, the BLS reported that inflation ticked up slightly by 0.6 % in August compared to 0.2% in July on a seasonally adjusted basis. The largest contributor to this increase was the gasoline index. Nonresidential Building Construction peaked in the first half of 2023, but continued increases at the pump could create upward pressure on construction costs through 2024.

There is a lot to evaluate when looking at BLS data, and it is important to understand trends in construction costs to help make future budget predictions for stakeholders. Our team of experts works directly with a national network of general contractors on the ground from a project’s inception to understand how construction costs are moving and how they vary from market to market. You need to hire our team if you want the best in the industry to manage your construction costs.